We’re here to help you maximise the value of Colloquial. We can provide tailored training, consulting and support at any step of your journey.

Need to rapidly compare your technology with another company? We provide a solution to rapidly compare technology and prepare for future change.

Often there can be people implications for your team and the other side. In most cases, your IT team will not be regularly undertaking M&A assessments. If you need an independent party who has been there, done that - we can help.

We provide the know-how to capture your overall IT landscape, the other party’s, and if requested to also provide an overview of observations, recommendations and rationale.

Our template covers all things Architecture. If you don't find what you're looking for, contact us and we'll either help you or steer you in the right direction.

Build your framework or start with a reference architecture such as ACORD, BAIN, or CAUDIT.

Use our default accelerators, customise, or start from scratch. You're in control.

Only needs Apps and Technology? Keep things simple by using only the entities that you need - add more when you're ready.

Colloquial supports Microsoft Teams and has APIs to integrate where you need it.

Our templates were developed by decades of experience, you can lean on our experience. It just works!

Architecture is most effective when powered by many contributors. Colloquial makes Architecture a team sport.

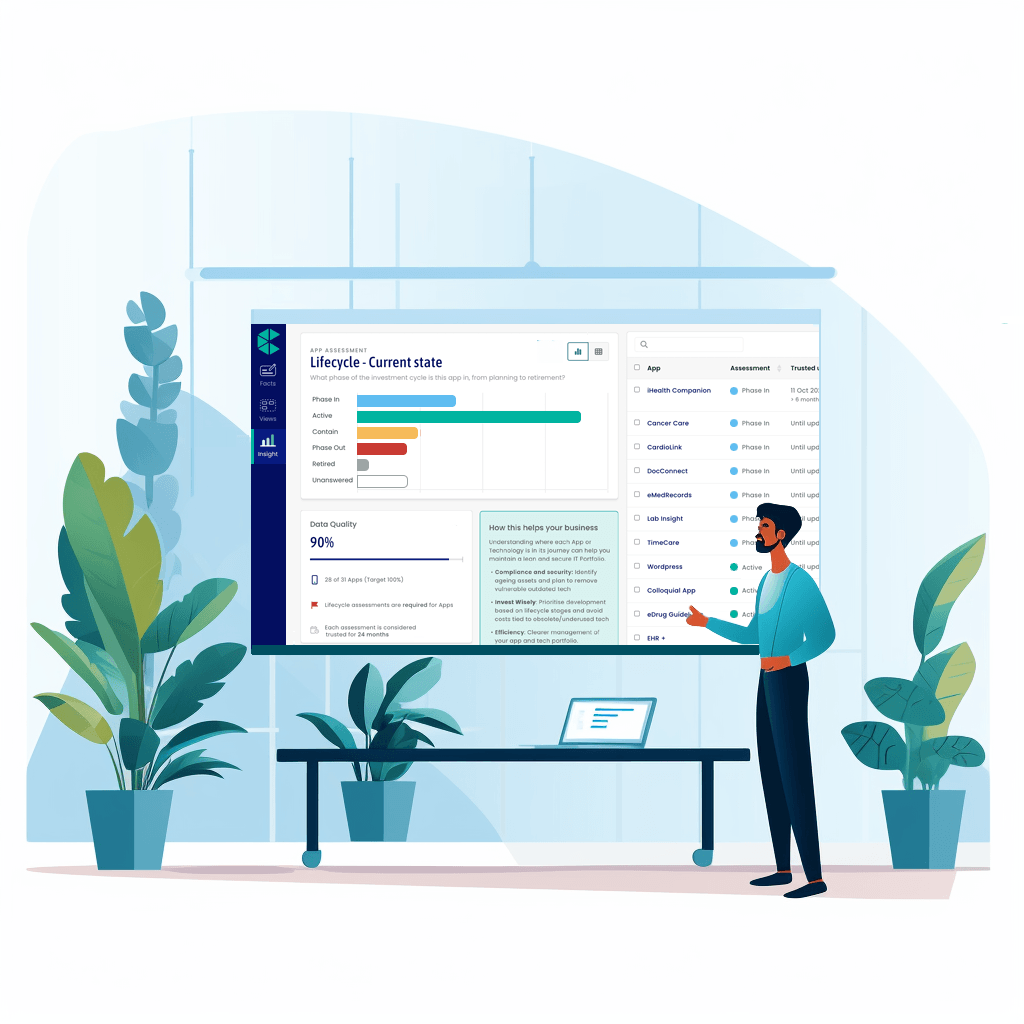

Start simple, finish strong. With Colloquial, your IT and Enterprise Architecture teams can leap from chaos to clarity in record time. Our platform doesn’t just manage your apps—it elevates your entire strategy, one informed decision at a time.

14-day free trial • No credit card required • Setup in minutes